child tax credit december 2019 payment date

Payments begin July 15 and will be sent monthly through December 15 without any further action required. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

Updates On 38th Gst Council Meeting Gstr 9 Financial Information Council Meeting

The IRS sent the sixth and final round of child tax credit payments to approximately 36 million families on December 15.

. Families who normally arent required to file an income tax return should use this. On June 7 the IRS officially announced the payment dates with the first round of payments starting on July 15 2021. Most families will automatically start receiving the new monthly Child Tax Credit payments on July 15th.

You will not receive a monthly payment if your total benefit amount for the year is less than 240. If you qualify the credit can be worth up to 2000 per child for Tax Years 2018-2020 in 2017 and. Dates for earlier payments are shown in the.

The current tax season has been as bumpy as the last with many tax filers reporting delayed refund payments due to IRS processing backlogs and reconciliation of catch. The next and last payment goes out on Dec. Half of the total is being paid as six monthly payments and half as a 2021 tax credit.

Future payments are scheduled for November 15 and December 15. December 13 2022 Havent received your payment. 3 January - England and Northern Ireland only.

Wait 5 working days from the payment date to contact us. If you qualify the credit can be worth up to 2000 per child for Tax Years 2018-2025 in 2017. If your payment is.

Besides the July 15 payment payment dates are. It is a partially refundable tax credit if you had earned income of at least 2500. The IRS will issue advance Child Tax Credit.

The payment timeline is as follows. Families will see the direct deposit payments in their accounts starting today July 15. Goods and services tax harmonized sales tax GSTHST credit.

Here are further details on these payments. The IRS has now processed the sixth December and final round of advance 2021 monthly payments for the expanded Child Tax Credit CTC to parents and guardians with. For these families each payment is up to 300 per month for each child under age 6 and up to 250 per.

Youll need to print and mail the completed Form 3911 from. Each payment will be up to 300 per month for each child under age 6 and up to 250 per month for each child ages 6 through 17. 13 opt out by Aug.

1200 in April 2020. 15 by direct deposit and through the mail. Treasury sends the first monthly round of CTC advance payments to families of more than 60 million children.

The next child tax credit check goes out Monday November 15. Some of that money will come in the form of advance payments via either direct deposit or paper check of up to 300 per month per qualifying child on July 15 August 13. So each month through December parents of a younger child are receiving 300 and.

To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates. The remaining 2021 child tax credit payments will be released on Friday October 15 Monday November 15 and Wednesday December 15. 28 December - England and Scotland only.

The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. Payment dates for the child tax credit payment.

You can beneit from the credit even if you dont have. 15 opt out by Aug. 600 in December 2020January 2021.

More information on the Child Tax. Check mailed to a foreign address. At first glance the steps to request a payment trace can look daunting.

The child tax credits are worth 3600 per child under six in 2021 3000 per child between six and 17 and. Child age 6 and above. It is a partially refundable tax credit if you had an earned income of at least 2500 for 2019.

Form 13 13a Instructions How To Get People To Like Form 13 13a Instructions Unbelievable Facts Tax Forms Irs

Sher S Theory On How To Rescue People From Flooded Caves Hi There This Is Sher Howtorescue F Student Loan Payment Student Loan Forgiveness Loan Forgiveness

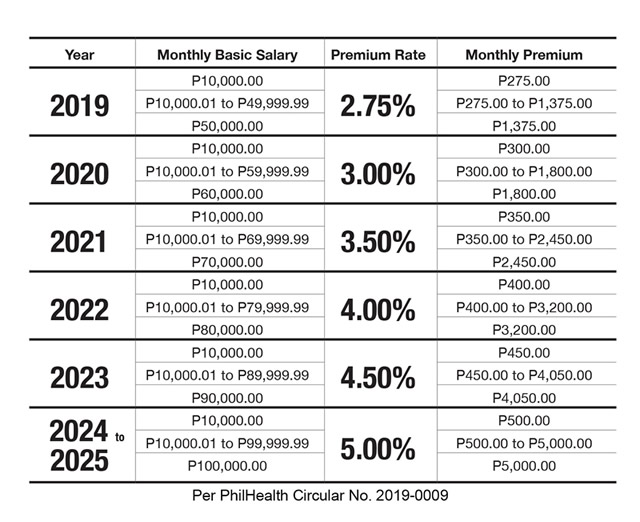

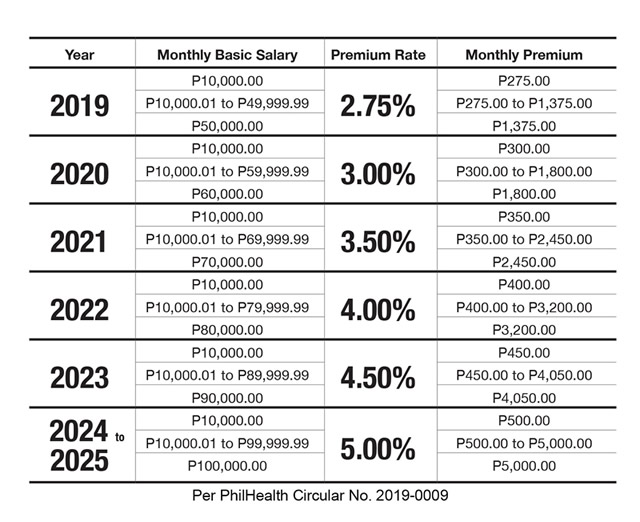

Philhealth Sets New Contribution Schedule Assures Immediate Eligibility To Benefits Philhealth

Gstr Due Dates List March 2019 Accounting Basics Important Dates Due Date

Gst Return Due Date List Jan 2020 Due Date Date List Dating

Goods And Services Tax India Gst Council 2019 7 Items Moved 28 Gst Rates New Gst Rates List 2019 Gs Goods And Service Tax Goods And Services Business Tax

Gst Number Search Online Verify Gstin Online Writing Numbers Taxact Search

Input Tax Credit Tax Credits Business Rules Reverse

F709 Generic3 Worksheet Template Printable Worksheets Business Template

Gst Tds Due Dates Jan 2019 Dating Due Date Important Dates

B2b Businesses Are Exempted From Using Rupay Bhim Upi For Accepting Payments Business Taxact Finance

Pin On Top Tax Consultants Lahore Pakistan

Gst Tds Due Dates Jan 2019 Dating Due Date Important Dates

5 Things To Remember For Us Expats Things To Know Us Tax Infographic

Don T Throw Away That Notice 1444 Tax Return Irs How To Plan

Missing A Child Tax Credit Payment Here S How To Track It Cnet

Pin On Taxation And Business Software

Check Out The List Of All The Important Due Dates With Respect To Gst And Tds For The Month Of February 2 Indirect Tax Goods And Service Tax Important Dates